#Fha arms length transaction guidelines full

Previously, HUD’s handbook incorrectly stated that if the heirs or the estate wished to keep the property, they would be personally liable for the full balance of the loan. Acceptable index options on FHA insured ARM loan transactions are 1) the Constant Maturity Treasury (CMT) index (weekly average yield of U.S. FHA Single Family Housing Policy Handbook Glossary Handbook 4000. In 2013, language for counselors and lenders was updated officially, stating that reverse mortgage loans are non-recourse, meaning that a borrower and his or her heirs or estate will only be responsible for repaying 95% of the appraised home value, rather than the loan balance if that balance is greater than the home’s worth at the time of sale. An Adjustable Rate Mortgage (ARM) refers to a Mortgage in which the interest rate can change annually based on an index plus a margin. In 2011, HUD published Mortgagee Letter 2011-16 to rescind guidance issued in 2008 to clarify its non-recourse policy on reverse mortgages insured by the FHA.

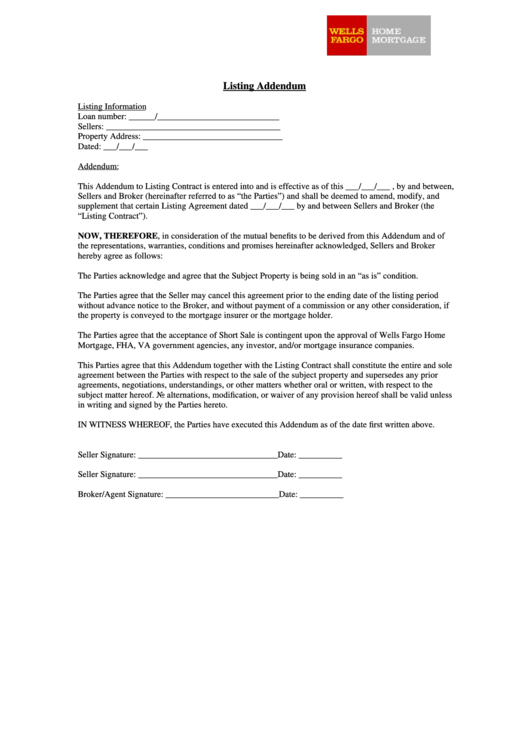

That means they have negotiated fairly on price, and neither party is giving the other one a deal better or worse than the market would dictate because of an existing relationship between them. The memo continues, “Until such guidance is issued, mortgagees are reminded of their ability to seek guidance and assistance in complying with both FHA requirements and any applicable state laws from FHA’s National Servicing Center.” yuoak / Getty Images An arms length transaction is one in which both parties are acting in their own best interest. “FHA is in the process of issuing guidance to specifically address the intersection between its policies and applicable state laws on this requirement.” “FHA is aware of concerns that the laws in certain states may conflict with its arm’s length transaction requirements for preforeclosure/short sales,” a memo states. The Federal Housing Administration is working on finding a solution to discrepancies in state laws regarding arm’s length transactions, but the agency says lenders should defer to state policy for the time being.

0 kommentar(er)

0 kommentar(er)